r&d tax credit calculation example

Instead they set a materiality threshold. The CARES Act created a refundable payroll tax credit called the Employee Retention Credit ERC for qualified wages paid by an eligible employer between March 13 th and December 31 st of 2020.

R D Tax Credit Calculation Examples Mpa

Tax and Duty Manual Part 29-02-03 6 22 Base year requirement7 The RD tax credit was originally designed to incentivise incremental RD expenditure.

. In the past. RD tax credit calculation for profit making SMEs. The calculation of future cash flows involves projecting earnings before interest taxes depreciation and amortization for each year through the remaining obligated lease term.

When accountants conduct an audit or review they cant test every transaction. For eligible taxpayers the credit is claimed on New York State Form IT-653 Pass-Through Entity Tax Credit and must be attached to a New York State personal income tax return. This two stage calculation is shown by the example below.

In December 2020 the Taxpayer. Credit Cards Insurance Mortgages Home Loans Credit Reports Scores US Economy Small Businesses Resources News About Us. Completing your tax return Employees.

And 2 all eligible payments to an energy research consortium for energy research. In this example the results of. For the accounting period.

However if any of those locations were owned versus leased then projected future cash flows should be calculated over the remaining economic life. Therefore why cant Tax Guru take a clear cut stand on this and why the PSU managements who deducted tax at source give the benefit of tax exemption in Form 16 to file refund claim in the tax return for the. How are RD tax credits calculated.

In this case the taxpayer from the example would. 1 basic research payments above a base amount. For example if a taxpayer has an initial tax liability of 100 and applies a 300 tax credit then the taxpayer ends with a liability of 200 and the government refunds to the taxpayer that 200.

The credit was equal to 50 of qualified wages paid up to 10000 in wages paid per employee with a maximum credit of 5000 per employee. In the chart above the Cumulative curve shows. Use of the Credit.

For the other corporations the Saskatchewan RD tax credit remains a non-refundable tax credit at the rate of 10 on eligible expenditures incurred after March 31 2015. Before April 1 2015 and after March 31 2012 the Saskatchewan tax credit was refundable for CCPCs subject to a 3 million expenditure limit and non-refundable in all other situations at the. This benchmark is used to obtain reasonable assurance in an audit or limited assurance in a review of detecting misstatements that could be large enough individually or in the aggregate to be material to the financial statements.

Total additional tax total additional contribution. If you ownoperate a Recovery Startup Business a business that started after February 15 2020 and has gross receipts under 1M you may still be eligible for ERC through Q4 of 2021. What is Basic EPS.

0 bracket plus 21 Earned Income Tax Credit phase-in. In general profitable SMEs can benefit from average savings of 25 so if a company were to spend 100000 on RD projects and make an RD tax credit claim they would be able to reduce their Corporation Tax CT by up to 25000 ultimately deducting 130 of the qualifying. Going concern S1057.

Track performance with dashboards. For certain research activities the RE tax credit allows a separate credit calculation equal to 20 percent of. What you need to know.

The program has now expired on September 30 2021 which means that in tax year 2021 the maximum tax credit available to an employer per employee is 21000. An eligible taxpayer claiming the credit must include an addition modification to federal adjusted gross income or federal taxable income on. The concept of diluted shares outstanding can be equated to a pie of sorts if more slices are cut to accommodate for an increase in the number of people sharing the pie that means that the size of each slice.

The amount which exceeds the cap is carried forward and added to. With a non-refundable tax credit if the credit exceeds the taxes due then the taxpayer pays nothing but does not receive the difference. Data collection calculation and analysis can all be automated including supporting work papers for tax provision tax compliance research and development RD credit uncertain tax positions and any tax data.

R. Basic Earnings Per Share EPS is a measure of profitability representing the amount of net profit allocatable to each share of common stock outstanding. An RD tax credit is not taxable income of the company.

For example if your marginal tax rate is 32 a 19500 Roth 401k. Our 4 step R. Since basic EPS is denoted on a per-share basis companies of different sizes can be compared against one another albeit there are shortcomings that you must be aware of regarding the use of this metric.

If you are an employee the amount of JobKeeper you received will appear as Salary or wages or an allowance or top up on your income statement or payment summary in your tax return. Using a Financial Advisor Retirement Planning 401k Plans IRAs Stocks Best Investment Apps Taxes. In order to capture the effect of the various peaks valleys and spikes remember the operative definition of marginal tax rate.

Credit Unions Investing. Ineligible expenditure under the R. Filing Taxes Best Tax Software Filing a Tax Extension Taxes by State Solving Tax Issues More.

Maintain a tax calendar with important dates and workflow for key business processes in corporate tax for example audit. 2003 was set as the base year for all accounting periods. For example if your annual interest rate is 3 then your monthly interest rate will be 025 003 annual interest rate 12 months.

This meant that if a company incurred expenditure on RD in 2003 the. Tax treatment is covered under Income Tax Act clause 1010ii wherein gratuity payment under the 1972 Act is exempt from calculation of previous years income. If you complete your tax return online this amount will generally pre-fill this information for you.

So included in the calculation ofaccounting profitloss may be deducted taxable profitloss. The calculation of the capped credit for RD workers PAYE and NIC is set out at CIRD89790 and CIRD89800. The RE credit is one of the largest business tax expenditures.

Many patented inventions are often small technical improvements on existing products or processes which can yield substantial returns. PTET credits from multiple pass-through entities are aggregated. The diluted earnings per share EPS metric refers to the total amount of net income that a company generates for each common share outstanding.

R D Tax Credit Calculation Methods Adp

R D Tax Credit Calculation Adp

R D Tax Credit Calculation Methods Adp

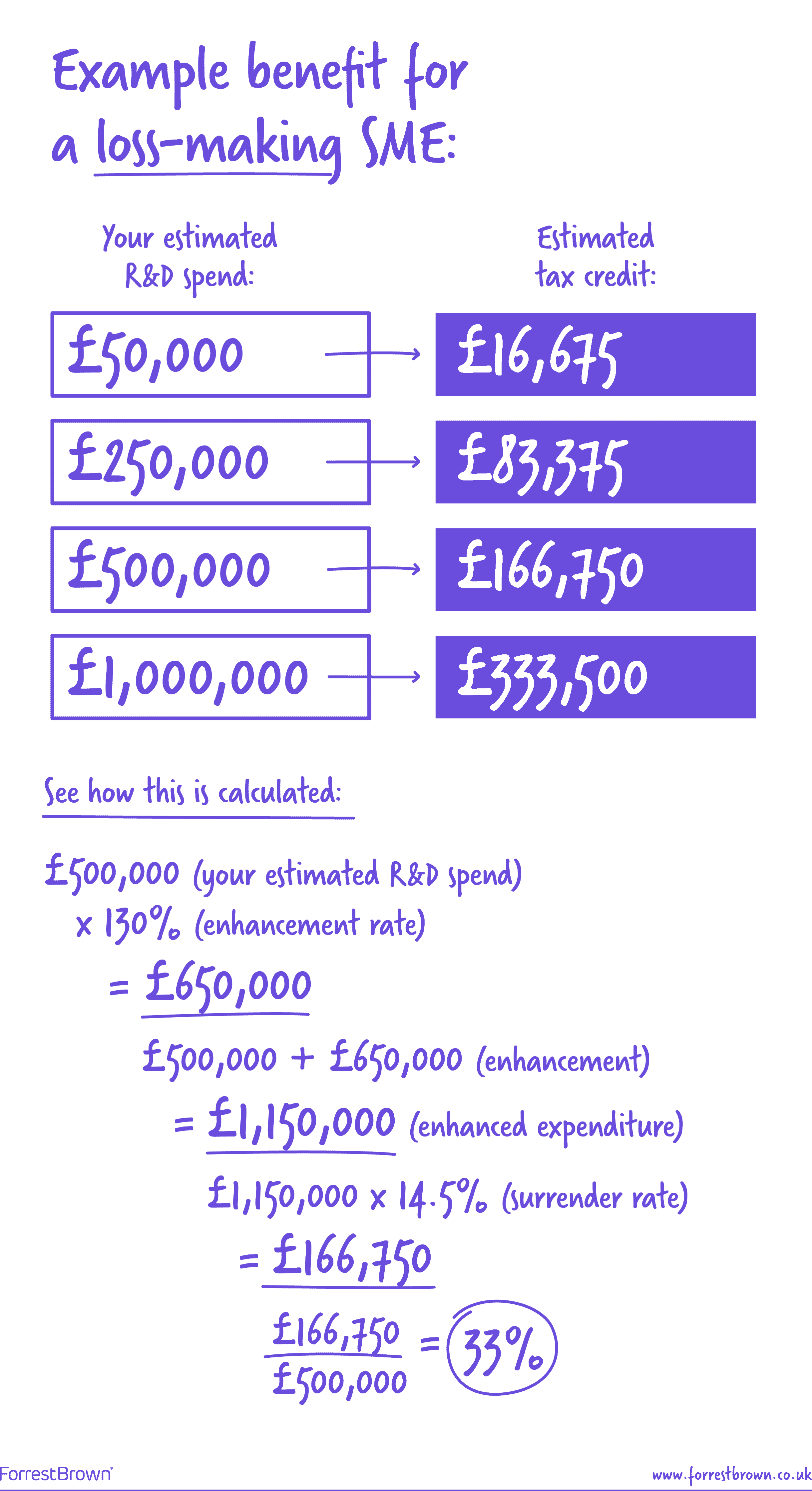

R D Tax Credit Rates For Sme Scheme Forrestbrown

Rdec Scheme R D Expenditure Credit Explained