personal property tax relief richmond va

On Friday county leaders announced a two-part plan to address. There are certain requirements they must meet to qualify for the tax relief programs.

Parking Violations Online Payment.

. Its tax relief for the elderly and disabled said Valerie. Owners of qualified vehicles assessed at 1000 or less will receive 100 tax relief on that vehicle. Important Information Regarding Property Tax Relief for Seniors in Virginia.

Make an appointment Monday - Friday or stop by at your convenience any day were open. Payment of the Personal Property Tax is normally due each year by October 5 see Tax Bill for due date. 1 day agoFrustrations rise in Henrico as personal property tax bills increase.

2 days agoThe board approved the measure 4-0 on Tuesday as part of an emergency ordinance aimed at giving relief to taxpayers. My office has used the same assessment methodology for at least 35 years. The city is helping eligible homeowners fill out.

The county also can consider high mileage and damage beyond regular wear and tear in assigning values to vehicles. Interest at a rate of 10 per annum is added beginning the 1st day of the month following the original due date. It was established in 2000 and is a member of the American Fair Credit Council the US Chamber of Commerce and is accredited through the International Association of Professional Debt Arbitrators.

Be 65 or older. County of Richmond 199 Va. The city previously offered tax relief to seniors and people with disabilities earning less than 50000 a year.

Box 27412 Richmond VA 23269. Real Estate and Personal Property Taxes Online Payment. For qualified vehicles the bill is reduced by that years tax relief percentage but only on the first 20000 of value.

WWBT FCC Public File. Residents who earned less than 20000 could qualify for. If payment is late a 10 late payment penalty is assessed on the unpaid original tax balance.

For tax year 2006 and all tax years thereafter counties cities and towns shall be reimbursed by the Commonwealth for providing the required tangible personal property tax relief as set forth herein. The Commissioner of the Revenue is responsible for assessing personal property taxes VA Code Sec 581-3100-31231. 2 days agoand last updated 120 PM May 11 2022.

HENRICO Co Va. 1 values for used cars. If the qualified vehicle is assessed at more than 1000 tax relief will be given at a rate of 40 up to a maximum of 20000 in assessed value for 2022.

Click Here to Pay Parking Ticket Online. CuraDebt is an organization that deals with debt relief in Hollywood Florida. WRIC If you live in Richmond and are over the age of 65 or disabled you could get a big break on your property tax this year.

WWBT - Henrico County is planning to provide relief to residents as they experience high personal property taxes. Personal property taxes are generated from the Jan. Senior citizens and totally disabled persons have the right to apply for an exemption deferral or reduction of property taxes in Virginia.

Personal Property Tax Relief The City of Richmond has two exemption options in addition to the Commonwealths Personal Property Tax Relief Act PPTRA which can be granted for motor vehicles. No relief for the portion of a qualifying vehicles value over 20000 is provided. Although the General Assembly has provided no definition for the term.

About the Company Personal Property Tax Relief Richmond Va. 2 days agoAccording to the county the real estate and property tax relief plans would save residents a total of 51 million in tax relief in 2022. Personal Property Tax Relief Does Your Vehicle Qualify for Personal Property Tax Relief.

Virginia Code 581-3503 A 18 specifies that for most items of tangible personal property that is used in a trade or business FMV is to be ascertained either by a percentage or percentages of original cost. Pay Your Parking Violation. Chesterfield Countys guidelines for.

WRIC If you live in Richmond and are over the age of 65 or disabled you could get a big break on your property tax this year. 804-768-8649 Administration Individual Personal Property Income Tax Tax Relief 804-796-3236 Business License Business Tangible Personal Property Hours Monday - Friday 830 am. Be totally or permanently disabled.

Condition and Mileage Adjustments. In addition Henrico maintains a personal property tax rate for vehicles of 350 per 100 of assessed value which is the lowest among major localities in the region. For tax year 2006 and all tax years thereafter the Commonwealth shall pay a total of 950 million for each such tax year in reimbursements to localities for.

-- Those living in Henrico County will have more time to pay the first installment of their personal property tax bills after a vote on. 734 101 SE2d 571 1958. Call 804 646-7000 or send an email to the Department of Finance.

If you have questions about your personal property bill or would like to discuss the value. Personal Property Tax Relief. The city is helping eligible homeowners fill out their applications for a program that reduces the amount owed on property taxes or eliminates them altogether.

Relief is provided at 100 for vehicles assessed at 1000 or less resulting in no tax due. Reviewing Personal Property Tax Accounts. Parking tickets can now be paid online.

Richmond VA 23225 804 230-1212.

Eliminating Virginia S Vehicle Property Tax Isn T Part Of Glenn Youngkin S Tax Relief Plan Wset

Population Wealth And Property Taxes The Impact On School Funding

Falls Church Joins Localities Implementing Disposable Plastic Bag Tax April 1 2022 Virginia Tax

Commercial And Industrial Sales Use Tax Exemption Virginia Economic Development Partnership

Real Estate Tax Frequently Asked Questions Tax Administration

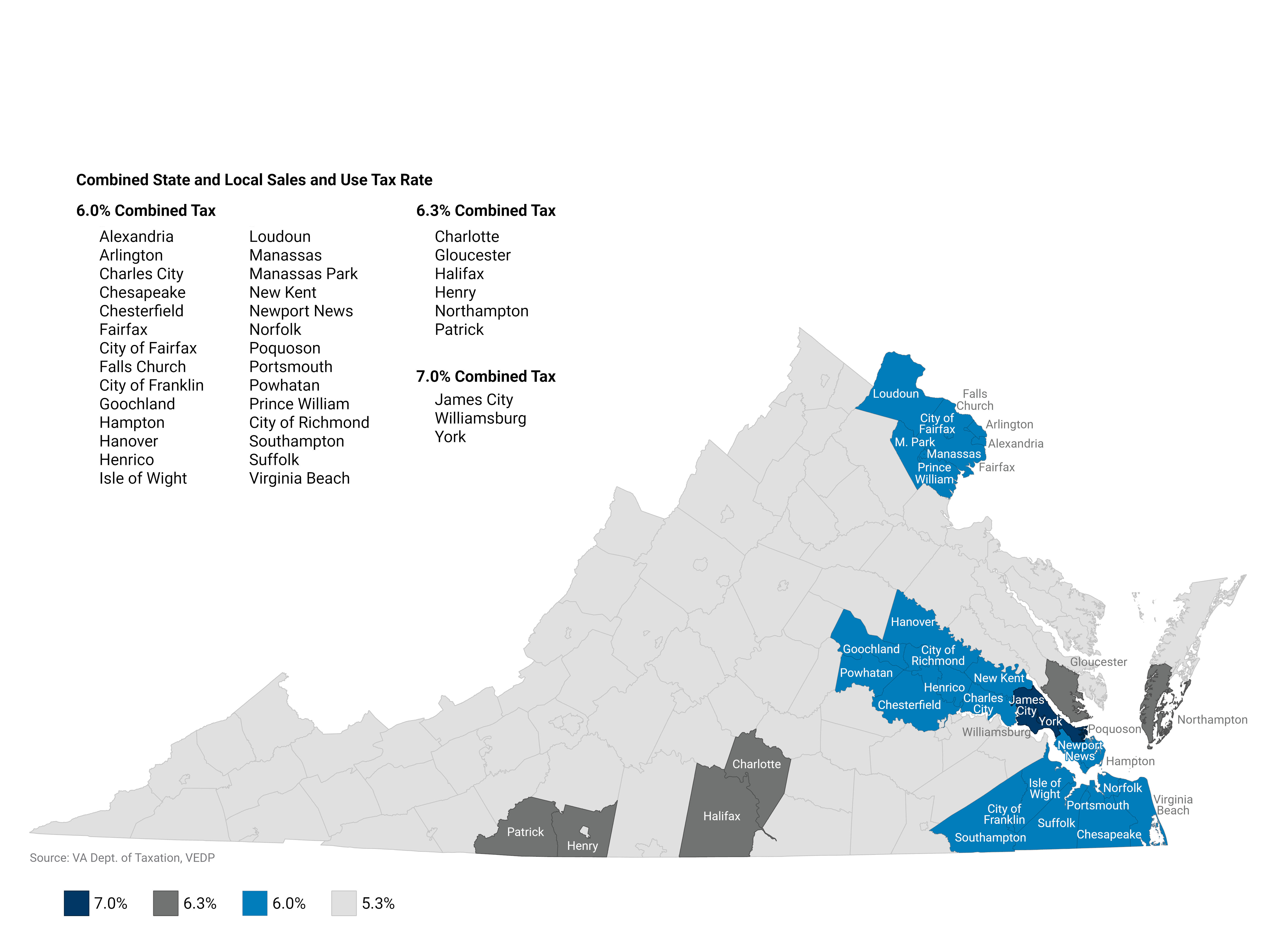

Sales Tax Increase In Central Virginia Region Beginning Oct 1 2020 Virginia Tax

Virginia Vehicle Sales Tax Fees Calculator

Pay Online Chesterfield County Va

Real Estate Tax Exemption Virginia Department Of Veterans Services

1099 G 1099 Ints Now Available Virginia Tax

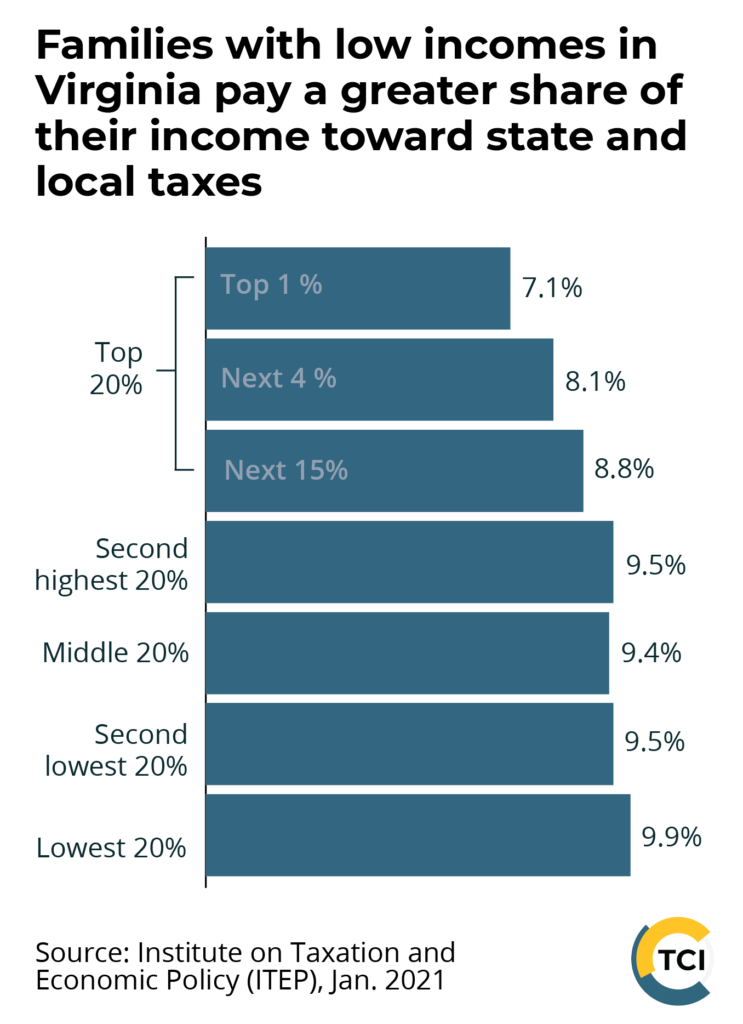

Tax Policy In Virginia The Commonwealth Institute The Commonwealth Institute

Do You Have To Report Va Disability As Income For 2022 Taxes Hill Ponton P A

Virginia Sales Tax Small Business Guide Truic

Important Changes For Individuals In The New Tax Law Kwc Virginia Accounting Firm

Virginia Sales Tax Retail Tax Increase Virginia Cpa Firm

Virginia Pass Through Entity Tax Legislation Salt Services

Mortgage Refinance Calculator Excel Spreadsheet Mortgage Refinance Calculator Refinance Mortgage Refinancing Mortgage

Please Join Us In Providing Hot Meals For The Day Night And Weekend Hospital Workers By Making A Tax Deductible Donation Hospital Workers Hot Meals Hospital